(TheNewswire)

| |||||||||

|  |  |  |  | |||||

Vancouver, BC – TheNewswire - August 22, 2024 – Global Stocks News – Sponsored content disseminated on behalf of Dolly Varden Silver. On August 19, 2024 Dolly Varden Silver (TSXV:DV) (OTC:DOLLF) released additional results from the Wolf Vein step-out directional drilling.

Dolly Varden Silver is advancing its 100% held Kitsault Valley Project, located in the Golden Triangle of British Columbia, Canada. The 163 sq. km. project hosts high-grade silver and gold resources. The recently consolidated Big Bulk project 5 km to the east is prospective for porphyry and skarn style copper and gold mineralization.

Drill hole DV24-412 averaged 606 g/t Ag over 16.20 meters on a 45-meter step-out from 2023 drilling and 31 meters below DV24-404 (previously released August 12, 2024).

Approximately 8,000 meters of an ongoing 25,000m drill program at the Company’s 100% owned Kitsault Valley Silver and Gold Project is being drilled at the Wolf Vein to expand and infill the plunge of high-grade silver mineralization.

Wolf Vein Step-out Drilling Highlights

-

DV24-412: 606 g/t Ag, 0.61% Pb and 1.43% Zn over 16.20 meters, including 868 g/t Ag, 0.18% Pb and 0.88% Zn over 2.27 meters.

-

DV24-414: 771g/t Ag, 2.93% Pb and 2.29% Zn over 3.77 meters, including 1,065 g/t Ag, 4.64% Pb and 3.48% Zn over 2.26 meters within a 15.02m wide vein breccia zone grading 254 g/t Ag, 0.86% Pb and 1.34% Zn.

“The strength of mineralization including strong native silver and pyrargyrite plus strong, accessory base metals appear to be increasing to the southwest as we vector towards a key structural intersection point,” stated Shawn Khunkhun, CEO of Dolly Varden Silver. “These holes, oriented by directional drilling, show excellent continuity of the high-grades at the Wolf Vein.”

A total of four southwest step-out holes have been completed from one drill pad. Dolly Varden Silver is using directional drilling technology to precisely target areas for step-out and infill work.

“Directional drilling allows you to position the drill bit exactly where you want it to be, without re-drilling hundreds of meters from the surface,” VP Exploration Robert van Egmond told Guy Bennett, the CEO of Global Stocks News (GSN). “It’s an ideal technique for us to explore the Wolf Vein.”

Drillhole DV24-404 (previously released August 12, 2024) is the initial "mother" hole on a step-out collared at surface. DV24-404 intersected 1,091 g/t silver over 9.38 meters, with significant base metal grades. (intervals reflect core length, true width is estimated to be 60 to70%).

Drillholes DV24-409, DV24-412 and DV-414 reported in this release are “daughter” holes directed off the initial “mother” hole DV24-404.

The wide, high-grade silver intersection in drill hole DV24-412 is located 31 meters below previously reported drill hole DV24-404 and demonstrates that the vertical extent of the plunging high-grade zone is consistent at depth.

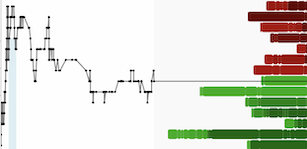

Figure 3 above: Wolf Vein showing higher-grade silver plunge (pink) within low grade mineralization envelope in red. Section looking northeast, 25 meters wide window.

On August 20, 2024 Dolly Varden Silver announced that a previously announced bought-deal financing of $25 million has been upsized to $28 million.

The upsized financing consists of:

a. 10,000,000 common shares at a price of $1.00 per share for gross proceeds of $10 million.

b. 14,400,000 common shares that will qualify as “flow-through shares” at a price of $1.25 per FT Share for gross proceeds of $18 million.

According to the Prospectors & Developers Association of Canada (PDAC):

-

A flow-through share is a type of common share that permits the initial purchaser to claim a tax deduction equal to the amount invested.

-

The flow-through share regime allows public companies to transfer to investors certain exploration expenditures conducted on Canadian soil.

-

Flow-through share financing contributes over 65% of the funds raised on Canadian stock exchanges for exploration across the country, generating significant exploration activity within Canadian borders.

“The exploration and mining industry in Canada—one of Canada’s leading economic drivers—has benefited from the flow-through share tax regime, which was implemented in the 1970s to promote exploration investment in Canada,” writes Bennett Jones, a legal firm with expertise in mining and capital markets.

On the DV Silver bought-deal financing, Research Capital is the sole bookrunner and co-lead underwriter, Haywood Securities is co-lead underwriters, on behalf of a syndicate of underwriters, including Raymond James.

DV’s precious metal inventory has increased 300% in the last four years through acquisition. Exploration drilling done after 2019 will be added in on the next property wide mineral resource estimate

Key Highlights of 2024 Drilling Program:

-

Three drill rigs mobilised

-

Initial 25,000 meters diamond drilling planned

-

Focus on Homestake Silver and Wolf Deposits

-

Follow up on new discoveries

“Exploration drilling is important for Dolly Varden,” van Egmond told GSN. “We see growth potential on the property. There's a lot of unexplored areas, and surface showings that deserve attention. The allocation of this summer’s exploration meters includes four or five targets.”

“Dolly Varden is trading at about $1.80 an ounce in the ground,” KhunKhun told GSN. “The average company trades about $4 a silver ounce in the ground. If our exploration program continues to hit high-grade silver as we have at the Wolf Vein, there is a likelihood that we are going to be revalued.”

On November 2, 2023 Dolly Varden Silver announced that it has closed a deal where Hecla Canada invested $10 million in DV Silver, raising its stake in DV Silver from 10.6% to 15.7%.

Hecla Mining has a market cap of USD $3.82 billion and trades on the New York Stock Exchange (NYSE). Q2, 2024 financial results released August 6, 2024 report revenues of $245.7 million, the highest in Hecla’s history.

Hecla’s bottom line has benefited from the rising spot price of silver - up 70% in the last two years, from USD $17/ounce to $29/ounce.

“Hecla’s increased ownership stake is a benefit to us,” Khunkhun told GSN. “Hecla has demonstrated it is a sticky shareholder. They're looking to expand their North American silver portfolio.”

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this GSN release.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: Dolly Varden Silver paid Global Stocks News (GSN) $1,500 CND for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we can not ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain “forward-looking statements” such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Copyright (c) 2024 TheNewswire - All rights reserved.