US stocks surged earlier this week as investors eagerly awaited corporate earnings reports to shake markets up after three consecutive weeks of losses. On the agenda for this week: updates from Tesla, Meta, Microsoft, and Alphabet.

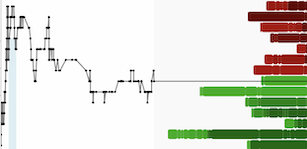

The Nasdaq Composite jumped 1.1% on Monday, with the S&P 500 not far behind, gaining 0.9%, and the Dow Jones Industrial Average making a 0.7% advance. What's not to like?

Well, let’s zoom out a bit. The S&P 500 took a hit every single day last week, ending up more than 3% lower in its worst performance since March 2023. The Nasdaq Composite fared even worse, dropping over 5%, marking its roughest week since November 2022.

Stocks have been on a rollercoaster ride lately, with escalating tensions in the Middle East and robust economic data raising fresh fears around inflationary pressures. The news that US consumer prices climbed 3.5% in March, up from 3.2% in February, hitting their highest levels since September 2023, has caused a reassessment of potential interest rate cuts. Powell's comments have led most analysts to believe that there won't be any rate cuts before the Fed's meeting on September 18. Some experts even speculate that there might not be any cuts at all this year.

The next few days will bring the release of first-quarter US gross domestic product data and the core personal-consumption expenditures (PCE) price index, which is the Fed’s preferred gauge of inflation.

But let’s get back to the topic at hand. This week is crucial for quarterly corporate earnings, with many of the highly anticipated "Magnificent Seven" tech companies reporting their results.

Tesla is up first on Tuesday after the bell. Tesla’s Q1 earnings will indicate how secure investors feel and whether the company will pass its three-month crash test.

The EV maker has been the worst performer not just among the Magnificent Seven but also in the entire S&P 500 this year, with Tesla stock plummeting 40%.

Analysts predict Tesla to report adjusted net income of $2 billion on revenue of $22.7 billion. That breaks down to 55 cents per share, a drop from the 85 cents per share reported in the same quarter last year.

Facebook parent Meta reports Wednesday, again after the bell. The social media giant has outperformed peers, with its shares up nearly 40% since January. Alphabet and Microsoft will follow with their results on Thursday. The other members of the elite club will report in the following weeks. Amazon and Apple will disclose their financials next week, and Nvidia is scheduled to unveil its numbers on May 22.

About 180 companies in the S&P 500 are set to report this week, so it's shaping up to be quite eventful.