"By Sea, By Land, By Air We Prosper"

Coat of arms of Vancouver

Read on for a very special conversation with Peter Grandich and Michael Stewart. I prepared a transcript of the call with the Q&A first. Enjoy!

--

PART 2: OPEN MIKE Q&A

MS: I'm in Toronto here and we're having these discussions now daily. This is very troubling times for the mining industry specifically in Canada. You touched on politics and our leader has stated without any real proof that they want to restrict foreign ownership in mining. Supposedly this is a policy for big mines but what defines a big mine? We don't know yet. Perhaps the first sign of nationalization is to restrict foreign investment. When you have a government that is running this country topsy-turvy with new policy, we don't really have a clear direction.

MS: Second, you've talked about the capital markets. The capital markets themselves could be the problem. Imagine not having a secondary market. You wouldn't be paying capital gains on a temporary gain with a switch-back on a January 1 stock price as you describe. You're now seeing a lot of private entities form over the last week. Another one yesterday. This is on Street worldly not necessarily in Canada. They want to form privately and stay private. This has not been seen before. Sorry. The other area that you've touched -- I'll get to my questions -- are liquidity. You've talked about ETFs, indirectly. The ETF formations here in Canada are unbelievable. In the month of May, you had 29 ETF form and they took down $4.6 billion. In the month of June, you had 15 or so. We don't have a number on that yet, we're waiting for the July ETF dollar value numbers. It should be up and out, but I haven't seen it yet. You're seeing this flight-of-capital away from the junior sector, whether it be in venture capital or in the junior mining sector as they are both basically the same risk profile.

MS: Something important you talked about are the advisors. Well, the financial advisors in Canada particularly work for the big banks. They're not allowed to advise on junior mining companies. We may have 15,000 advisers in the Greater Toronto Area and they can't talk about junior mining companies. Why? There could be many reasons. There's no way out of this in a hurry. We've got elevated commodity prices -- that could be good or bad for the industry. Right now, we're seeing depressed valuations on record commodity prices. This is a big issue. I work with a lot of mining companies and I know a lot of CEOs personally as good friends of mine and junior miners. I don't see a fast way out of this.

PG: I agree. I don't think there's a fast way out of it. You bring up some points that aren't being discussed. Another thing that's changed is that we used to have teams of people who have moved on to other areas. There may be one elder gentleman or woman who was around who still answers the phones, but they're not seeing any new real capital to go and play the markets. We're starting to see the majors make some decent free cash flow in good size. They have to fill their mining reserves and I don't think they're going to reach down to the bottom of the junior market anytime soon, but they certainly have started an M&A process. Obviously, you're involved in the industry. I've made a big bet that a lot of that is going to happen out of Quebec. One of the reasons I feel that Province of Quebec is so open to mining versus a couple others. I concur with everything that you said. I think the people that complain need to appreciate all the things you and I discuss. If you understand that then you can say to yourself -- why is gold 2500 and my share is trading like it's 500? I wrote that on Twitter today. I remember being at PDAC going man -- if it can get to 400 then things would get better. Now it's 2500 and I feel companies have a tougher time today than they did when it was 400.

MS: Talk about Quebec -- we've got 13 jurisdictions in Canada. Three territories and 10 provinces. The mindset is changing from the regulators from the provincial and territorial governments. It is very importantly to see the voice of First Nations and original peoples in the Arctic. They have a big say in this. I think a good part of the junior industry has taken this for granted, mistakenly. This is not a surprise. I had a conversation with chairman of gold company and a Bay Street broker just three days ago and a two-hour Zoom call specifically about this -- it is an issue. We're not all on the same page.

MS: In Quebec, the environment is changing. The governments are forcing the juniors to find their own way towards getting permissions from communities permitting from First Nations. Governments are backing off on this. I believe the governments are talking out of both sides of their mouths here these days. Next week, I'm attending the two-day conference for the Critical Minerals Institute and we're going to be able to see and hear what the sentiment is beyond the politics. Beyond the election timings. We've got this EV failure here in Canada -- it's left, right, and center but all the infrastructure of that is falling to pieces. As an industry in Canada, I'm talking specifically from a Canadian perspective, we have an opportunity here to take the bull by the horns and get back to what we were very good at in in this great country. If they're going to say no to foreign investment then we're going to have to do this ourselves. We've got all the goods.

PG: Mike, please let me ask you a question if you don't mind then I'll be glad to answer any of yours. How about the potential change in government? The lead candidate who's currently running against your Prime Minister -- do you believe that him and his group will be part of change for the better?

MS: Conservatives come into power here much like in the United States. Not an overstating factor -- if you look at the amount of time spent by each government then you will see that we primarily have liberal governments here in Canada, federally. Conservatives keep them in check and this conservative movement that's happening now is not extreme at all in business. In fact, some of the campaign messaging on mining is that they want to bring First Nations closer into this transaction, which I think is a very valuable step forward. It might diminish the junior minor somewhat, but for the grand scheme I think that bringing the partners and stakeholders together rather than separating them is a good good strategy.

PG: I agree with you on that. I'm sorry to interrupt but a company that I invested in specifically did that -- it took longer but it helped their future. Northwest Copper and Gold. I think that's the only answer.

MS: Peter, I'll ask you -- how do you choose a junior miner to invest in? Or to look forward at? Capital is light these days, capital is scarce, and part of the job of that junior miner is to de-risk anything to do with the project. The junior can move it on either into bigger hands or further the project itself, but de-risking the relationships with First Nations to show this is an ongoing process is important. And the cost of that de-risking is less budget, perhaps, than drilling and all the technical sides of the exploration business. It's required. I have conversations with friends that think that's a good idea to get closer to First Nations. This is a big thing.

PG: Consider that I'm somebody who has now limited what's left of my natural life exposure to North America. I don't ever see that changing again. There aren't that many states in the West that I would jump into. I also decided that not only would I limit my area, but I'm really riding the coattail of just one person who I think is a lot smarter than me -- what he does within the confines of North America is what's going to interest me. That's how I've decided to approach this, but I think you've probably made some of the best, valid points that I've never even heard from so-called experts. I appreciate what you shared with us today, Mike.

MS: We missed you the other day in Toronto. Both those companies are friends and both are interesting. I guess my question is what would you have said if you were with us? You're here with us today.

PG: In a sense, I would be a little defensive for Warwick Smith -- when a stock is down 80 or 90% from its high, it's very hard to find positive fundamental reasons because there are reasons for it's decline. I think everything that I've seen him do was in the best interests of shareholders. Unfortunately, one of the things that's happened in cyberspace is important -- I'm glad you brought this up and please give me a chance to say it publicly. I've always knew there'd be criticism in this business. I worked with professional athletes for 20 years and one time I was at a spring training game when one of my clients was pitching. There was just a guy sitting two seats or three seats away and he was calling them every name in the book. Bad names, too. That evening we all got together and we ate. I turned to the guy and say doesn't that bother you? He says think about it -- I'm on the field and he's sitting in the stands and that's good enough for me. We had somebody who was part of these chat groups who was like this and I understand the public has limited access so they turn to these forums in hope of learning things. I have no problem with anybody who substantiates who they are, where they're coming from, and I'd be glad to address them even if they totally differ with me. When they remain anonymous and make accusations without any ability to not only support them -- by the time you go through the legal process, many times those people have little or no funds to collect if they caused you damages. I say to people that it is very unfair. Keep that in mind when you're looking at that person they're accusing of being bad is a public figure who has to answer to regulators and is themselves known publicly, whereas the person making the accusations refuses to come out from behind their computer screen. That probably would have been something I would have said with Warwick Smith standing there. It doesn't take away from the count that the stock has come down even more than average for the peers. Expectations that they are going to be successful haven't hit yet or may never hit. I tell people there are 12 blog sponsors now and if we're still alive three to five years from now then who will remember my role in the deal? Things just don't work that way. Failure is the norm in the business. One of the things I would have done there is to be somewhat defensive. For him and all of those in an industry where failure is the norm -- and I wish all the investors would hear what Warwick Smith had to say about how much more challenging it is to be a CEO now of a junior than it was 20 or 30 years ago! No question about it.

MS: I met Warwick Smith when they first went public. I met Joness Lang, who was representing the other company, almost as long. Both are Champs. I was happy to be there and it was a lot of fun. It was a different concept. It was a mingle versus hardcore presentations. I met some friends and met some others who are on here now.

PG: Those two are both good people. I just added to Canter Resources because I just think their initial exploration has been great. Having said all that, I have to learn these lessons again and again. This may open the door to another question from you -- I got deeply involved in the last couple of years again in a stock where it turned out that the management was ill prepared. I take some credit or blame for part of the reason why they're gone -- it was a dramatic change for the better and proves to me how important is management. Most of these companies are run by one, two, or three people. It's not like there's hundreds of people in different departments. The only bad thing about Warwick Smith is that he's a Vancouver Canuck fan -- I think it's taking years off his life if he stays there. Other than that, he's all right.

PG: Mike, I'll take any other questions. I see there are two others. I'll turn to them if they want, but I want to go with you again. You've been kind enough to be with me from the start. I know you said you had some questions, I want to answer them.

MS: If the groups are identifying the problems then what next? Whether it be politics, the industry itself, the capital markets or lack of capital, or the regulators -- this is a perfect storm for a lot of things. There's been no real flight of capital anywhere. It hasn't come in yet. We're not a winning sector. You say you gave up on Canadian business media -- I gave up on them a long time ago, but I watch the US shows now. I get more information there than we would here. Mining companies advertise down there on Business or Fox Business or whoever. My questions are related to my belief that there a lot of opportunities for grassroots to come together and form groups to ascertain the problems. Nobody wants to admit to them. It's so competitive that nobody wants to get together, but this is mandatory. A big mining chairman reached out to me the other day and we had this two hour Zoom call only about this subject -- on Wednesday afternoon.

PG: It's always been highly fragmentized. There never was a marketing arm. There is the World Gold Council and a couple of things like that, but they were never for the mining industry quite frankly. I can think back to my money management days. Mhen I switched over and managed a couple of hedge funds, some Main Street guys that I knew were asking my what I was doing with those kooks in Canada -- I don't think much of that attitude has changed yet. I still think the US investment community has no understanding or realization of how dire it's going to be for metals if the junior market can't go out and spend the adequate money. Since you're involved in this, you know that not only is it more difficult to work in certain areas of the country but some of the better deposits or higher grade stuff has been basically used up! This week as I adjusted my portfolio through today as the discrepancy has become so bad -- even if a lot of things you and I just discussed don't get fixed then they're still too cheap! They may not get to the levels they deserve to be at, but they've gotten too cheap.

MS: There have been cycles in this before. We've been in a long bear cycle with high commodity prices. Not all of them are high in comparison. I love base metals and I can complain about a couple prices, but copper is not the complaint. Other pieces are -- zinc and nickel. There's a lot of space availability here in Canada to really knock it out of the park. There are super opportunities here. We've got three oceans. A lot of our projects are near tide water. We've got limited rail in Canada that goes east-west but this is a pretty good place and a pretty big exporter of materials.

PG: Don't have to sell me Mike, we got to sell the world!

MS: But the junior sector is what makes this all happen. I've talked to the biggest royalty companies in the world with the chairman who recently schooled a group of us who were together -- he schooled us on why the tuniors don't deserve what they have right now. It needs to go back to grassroots. It needs to be grub staked. It needs to start private and build out from there. A lot of these companies are lifestyle companies that come onto the market. When a new person comes into that industry to invest and they get burned by that -- and they do get burned -- they don't come back.

PG: I've experienced that. I'd always say that I'd prefer if we had one-third of the amount of companies because two-thirds are really lifestyles or on life support.

MS: That's the nature of the beast, though. They're in between gigs or whatever it is. They've sold out to a bigger companies and now they're looking for the next thing -- they can sit in perpetuity before they dwindle down, which happens so quickly. It's a lot of money to keep these things alive now on the public market here in Toronto. The TSX Venture bare minimum is $400,000 just to do that.

PG: Thanks Michael, I think you have some points that the whole investment Community should hear. Never Say never, but I've concluded two things for myself. One is that I would narrow my scope to an area of the world that I felt most comfortable about and that was North America. I like the joke that if it's south of Miami I won't even go. The bottom line is that's the first priority. The second is probably more important when I discovered Michael Gentile through my getting reacquainted back into the junior market. I had stepped out for several years in 2013. I left that industry in any way shape or form as a livelihood and focused full-time on a business that I already had, which was money management here in the US for professional athletes. However, I got back into a deal and before long we realized the management was horrific. I had to speak up about it and then when that management left, I got this call from this guy Michael Gentile who said he was on the board of a company that was trying to deal with that company and he couldn't be believe that the guy's gone. He wanted to talk to the guy that got the guy to go. That's really how I met Michael Gentile. What clicked early for Michael and I was that we share a deep Faith together. That probably is more important to both of us than all the mining stuff we've done. I concluded he was a lot smarter than me and that interested me. With all the people I've met in the industry who are smarter than me, I knew I would never be up at their level but if I could identify the best ones and ride their coattails then I'd be better off than trying to go at it myself. I became entwined with Michael. I don't know how many positions he has now, maybe a couple dozen investments. He's usually the largest shareholder or one of the largest. He separates his business from his investments, he's also a money manager dealing with much higher stake companies. The two that you mentioned are probably similar to him in his net worth are similar in percentage terms to mine. I think his largest single shareholding is the same as my single largest shareholding, Arizona Metals. Then Northern Superior and North Isle Copper are probably his next two largest individual holdings and they are both for me, too. I think the situation in North Isle was kind of interesting because it's very rare when you see insiders at juniors putting a big stake up for themselves. This CEO did that. Apparently he took most of whatever his worth was to exercise options that he didn't have to. That really will only benefit him if the stock goes up, which to me on top of everything else with the company was a real eye-opener. That one act, in addition to everything I already knew about it, caused me to more than double my stake in it. Northern Superior is more of my belief of Quebec in general. I hadn't spoken or attended a mining conference for almost 11 years, but I went up to Quebec City in June. I was really only going as an attendee, but then when they heard I was attending they asked if I would speak and that's the only reason I spoke. I sat in for the IAMGOLD presentation -- it's online and I put it up. The CEO only said it in one sentence, but the sentence to me was worth a thousand words -- he said he envisioned his company eventually becoming Quebec Incorporated. Ironically, we would break for lunch and go down to the restaurant in the hotel across the street and I sat next to him. I started joking and poking him a little bit. It turned out both he was friendly with the CEO and Michael Gentile. I came away from our poking exercise thinking that this is something serious -- once they get over the hurdle of bringing on this mine that almost took the previous CEO and the company itself down for the count. Apparently they have turned things around. I think that if you're patient enough and given what they sell for now, it's hard to think that I'm going to lose a lot of money in them. But that's just my perception and it doesn't mean that's not going to happen. Arup talked about a company that I owned at one time. In fact, I don't even know if it goes all the way back to when I was still managing money -- we bought Northern Dynasty at 50 cents I think it ran to 15 or $20. And then it ran back to 50 cents. It literally became too big. That was probably one of its biggest problems -- it's too big. Regarding Michael Gentile, whatever you may think about him in terms of how he is handling things financially -- his love for his family and his love of his faith is 10 times stronger. That to me is a very important characteristic for someone in my point of my career that I'm going to be involved with.

MS: Peter, when you talk about Michael Gentile and when you look at the companies he invest in -- the teams and the property opportunity -- it cuts down your due diligence automatically when he's involved. The scoring that I do is based on the team, the project, and the ability to raise capital.

PG: There's no other due diligence that I can do that I don't think he's done already.

MS: These are very important aspects of junior mining: the team, the properties, and the ability to raise capital. You can be missing on one. You can augment onto the team or you can add on to the property. But the ability to raise capital comes easier when you have Michael Gentile involved backing that story. He's only been doing this for seven years since around 2017, I think. When you see a Gentile story -- and I know most of them -- the team is good and the properties are delivering.

PG: Sometimes we initially see a phenomenal project, but as it moves on we realize that the current management was not going to give the best chance for it to move forward in a way that it deserves. In a sense, I became the bad cop and he became the good cop. That was fortunate because when the change came, it came with two people that we think couldn't be better. The blessing in that was even when something unfortunate, not seen originally, happened -- the change was for the better.

MS: Again, this is important for juniors. When you can attract talent like that as an investor, there's follow-on to that. There are other things that come with that. This is so important.

PG: I can't agree with you more. Our initial discussion was most valuable to me today. I have to tell you that I didn't come in an expecting I would learn anything but you open my eyes and ears to some things, Mike. I told Michael that Canada was my home away from home and I'm making one more trip up there -- I'm going to Vancouver at the end of January. Michael Campbell runs a conference called the World Outlook Conference and it's going to be my thank you to Canada for decades of enjoyment.

--

https://www.youtube.com/watch?v=TCfkeg14Kow

PART 1: PETER GRANDICH SPEECH

Hello everyone, this is Peter Grandich. There were 13 of you that wanted to hear this talk I planned to give a few das ago in Toronto but was unable to attend, and only one gentleman has showed up today to hear it live online. Hello, Michael! Thank you for being an audience here. What I'm going to do, Mike, is go ahead like the other 12 were here. I'm also going to provide this later out to others. When I'm done speaking, please give me any questions you have. I'll be glad to try to answer them.

Thanks for having me.

Well, thank you for being the one out of 13 that made it! There are a few that were supposed to be here but I don't know what happened. What I would have shared there a few days ago in person if I had been able to attend is as follows, although I have updated it a little bit because a few things have happened since that Toronto conference earlier this week. I think the two things that I wanted to get across was a general observation about markets and then specifically about the junior resource market. There were two companies that were hosting the event and I had some comments on them.

My general overview concerns political, social, and economical aspects just related to the United States. I think Canada and the United States have a lot of similarities -- if we exchanged our leaders, we'd each think we got the short end of the stick. I think it is important to keep saying some of these thins over and over again -- most Americans are not listening. We have a huge debt problem now and it's become acute. It's been around for a while. It's not the first time people are talking about it, but it's now gotten to a level where paying the interest will become a legitimate concern. And the reason it's a legitimate concern starts that we at $35 trillion and running multi-trillion dollar deficits each year. Our Congressional Budget Office, which is probably the last place in Washington that has any bipartisanship left, has been calling for $54 trillion in less than 10 years -- without a recession in any of those periods. If it gets to $50 trillion in less than 10 years and we put just a 5% interest rate on that amount then we have $2.5 trillion in an interest payments. Our best year ever was two years ago when $5 trillion and 300 billion in tax "revenue". We're going to see almost half of the United States government income going to pay interest. There's one thing to say, simply that we won't be able to get the same services that we have grown accustomed to -- including defense and everything. We'll probably have a much higher tax rate and things that aren't being taxed now will probably be taxed, including the most dire stupidity of all -- a thought that is actually being considered to tax unrealized capital gains. It's like telling somebody you got to pay the taxes on a winning in a horse race while the race is still going on. I always tell people how asinine that is to think. It's absurd. And there is talk of raising the time that people have to consider for the calculation of cost base. If you have a farm or something is that passed on through two, three, four generations then it will face much bigger capital gains taxes. But how do you get those records? It's just one of the absurdities, but it is an issue that I still think most Americans are not focusing on. They'll only get around to focus on it when they realize that a lot of things they grew accustomed to are changing. Most people in my opinion, Mike, are going to be around for this. This isn't something that's way off yonder.

The second one is probably happening in Canada too -- the retirement crisis. Not only are 65% of Americans working paycheck-to-paycheck now, but most of them are not going to reach that part of life you see in the advertisements from the financial service firms where you play golf, sit at a pool, and fish for the last 20% of your life. As we get older, we actually need more help and we'll be dealing with a government that's already acutely in a bad way. The second part of that retirement crisis is that we have an aging crisis. The Boomers are peaking and there are less and less of us. As the money shifts away from the very older into a younger crowd, the political power that the older people have will be lost. One day, some young person is going to say if gramma makes it to 90 years old and needs a million dollar heart transplant -- they lived a full life, I can't put food on my table, you're taxing me to debt, let the old man die. People say that's absurd and I say look around. In Canada and in three states in the United States now, we're encouraging people that are destitute at older age, whether it's medically or financially, to consider taking their own lives. I think that's the most horrific thing that's happening to decide whether someone lives or dies based on their financial status. I think that's an horrific thing. That's down the road, but it's within sight.

The third is the immigration. That's happening worldwide. It's happening in Canada. People will be surprised that Canada's probably been more overrun than the United States percentage-wise on how many people have come in, versus the total population. The problem is a huge economic issue. I'm not going to talk about the terrorist part. I'm not going to talk about the political ramifications and how they're going to vote. I'm just going to look at them as an economic number. No matter what the government tries to tell you differently, they come as a liability mostly -- not as an asset. It's been estimated that it's costing the United States over $6 billion for one year's worth of federal aid. That's not talking about states and cities. That's an issue that doesn't seem to be getting addressed Whether or not there's a change in our government, it's something we have to consider.

The fourth is what I believe, Mike, is the most overlooked and mistaken judgment in the modern era by the financial community -- not appreciating and understanding the ramifications of the BRIC nations, the formation of them, and what it's going to mean. I can understand when it was a handful of countries and nothing was really happening. Then a few more joined, but now we're looking at as many as 50 to 60 countries that want to be part of it. We've also gotten some indication from them on how they will go about tradin. What I try to tell the American financial advisory community is that we are going to be on the outside looking in. We're not going to be part of this. In fact, the main reason the groups are forming is not to be involved with the United States! Both from a trade standpoint or using our currency. They've already given clues on how they're going to do that. Part of it is a new kind of unit that will be made of their currencies and gold. Wall Street is totally unprepared for this. They've not taken it into account and they still laugh at it. I don't think they'll be laughing quite as hard after these upcoming fall meetings.

The fifth one could fix any one or all of these four other problems, but it's probably the most broken of them all! And that's the political paralysis here in the United States. The two main parties can't even go in a room now let alone expect them to sit down and put together worthwhile legislation. I deal with a lot of business owners in our planning group and they'll tell you in the last 20 years it's not the fault of any one side of the aisle -- there hasn't been good legislation for a business owner in over 20 years. It's unrealistic to expect much from this group who cannot talk to each other and each have a splintering group within themselves that's either moving further left or further right. One thing is for certain, if you and I were having this conversation 20 or 30 years ago and I said we had a President who was impeached twice, as soon after he wasn't the president they accused him of a revolution, and they brought all sorts of charges on him where he's been found guilty, and they tried to kill him -- you and I would have said, what third world country are you speaking about, Pete? It's the United States now!

The other thing I'll say before I get to metals and mining is the complacency now. I don't listen to Canadian financial news networks like I used to, so I don't know how the investment community is thinking in Canada. Here in the USA, the complacency among the professional community is only rivaled by the public's lack of real concern. We have taken things for granted and just assume somehow these things are going to turn around and be fixed without any major issues.

The last comment about the stock market is very important because there are people that are going to watch this, Mike, who are traders. I say to them -- good luck. When I entered the business, 90% of the trading in 1984 was by the public. Now over half the money that's in the stock market is in passive funds, meaning it's being managed not actively. It's either in an index type of fund or something that's tracking some other performance. As long as there's no change, that manager is not thinking each day whether they should sell this ot buy that. Of the remaining 50% of money in the market, probably 80% of that is some sort of computer algorithm program. It may simply be trading because of headlines and words that are in headlines. There are very complicated trading formulas that involve futures, options, and all sorts of things. The individual buyer and seller of stocks for the original reason -- to be part owners of a business -- has shrunk dramatically. Anybody that's investing like its 30 or 40 years ago, or using rules of investing based on 30 or 40 years ago is going to have a real serious problem. This game is completely changed.

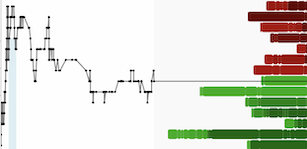

Before I ask if you have any questions, Mike, I'm going to cover the market. Especially because today, as you and I are speaking, I announced to everybody that I am truly all-in on one area: metals and mining.

One of the things I wanted to share at the speech I wasn't able to give in Toronto was my belief that the junior resource market is not anything that it once was. That's hard for guys like me who have been in and out of it for almost 40 years.

The reason I say that is three things.

First, for a junior company where failure is the norm -- where seven out of ten are not going to make it, no matter how honest or hard they work -- their primary source of interest from retail used to be generated by financial advisors who we would call stock brokers. We became financial advisers who built a book of business around buying and selling juniors. It might have been part of their business or it might have been all of their business, but that junior company who would go to a mining conference where it would meet hundreds of folks like that -- the company would only have to find one who opened the door to dozens or hundreds of clients. That's a dinosaur. There may be a handful of people in North America that still do that but the incentives changed -- no one's paying full commission or anything near full commission anymore to make transactions. That was a viable source of interest that a junior always has to find because it's a burning match stick. It's always going through money when trying to develop a project and needing new investors.

The second was regulatory. Here in the United States, even if they have an OTC Bulletin system most full service firms won't even allow an unsolicited order. Then, of course the discount brokers have now stopped allowing that too.

And the third real killer was cryptocurrencies. I'm not a fan of the crypto Market at all. They took the money that would have likely found its way, partly, into the junior resource market. I doubt anybody under 40 or especially under 30 is actively in juniors and not owning cryptocurrencies. That's been a challenge and will continue to be a challenge for the junior resource market.

This will be the last thought, Mike.H Having said all of that, you can't take the "Don't Worry Be Happy" crowd at face value. The ones who say the economies are going to be great and the world is growing so you should own stocks, AI, EV, or whatever it is that's going to generate all this value -- well, how do you meet the demand for metals that are going to be needed for this growth? One thing is for certain, the ample amount of supply of metals that used to exist 20 or 30 years ago just isn't out there. One of the reasons is the mining industry has not had been incentivized to spend a lot of money to look for new metals, especially with issues now in the world where I think the globe has shrunk. Certainly, I'm only staying within North America. And even then, there are Provinces or States where I might think twice about investing. Let alone the rest of the world! If you believe that somebody has to find these metals that are going to be needed and if you believe that significant mining discoveries can be done by juniors, the discrepancy between where they're pricing the average junior resource stock today and where the average metal price is further apart than anything that was ever imaginable.

I announced this week that my only investments are cash, physical gold, and junior resource stocks. That is not advice for you or anybody else, Mike, but that's how convinced I am. I cannot find another sector, although I have tried, that is as undervalued as this market. It's not changing tomorrow -- it's not going to change suddenly on Monday and just go up while everybody goes into it. You have to go in on the belief that the turn is inevitable, when it comes it's going to be huge, and it's going to be quick so there isn't going to be a chance to wait for it. Hopefully, after it initially pops you can get enough of a pullback where you can go in. That's why I've committed the way that I'm doing now. With that, you have the exclusivity to ask Pete Grandich questions as long as you got, Mike. I'll try answering them.

--